This article explores the current landscape of ESG data collection and reporting, and highlights five key challenges presented by these new regulatory requirements.

Environmental, social, and governance (ESG) data is important for investors, financial institutions and other stakeholders as they seek to understand the long-term sustainability and resilience of firms. In addition, there has been a push from regulators and the public for increased regulation related to ESG reporting, with a number of new requirements currently being implemented by regulators to improve the quality and consistency of the data being disclosed."

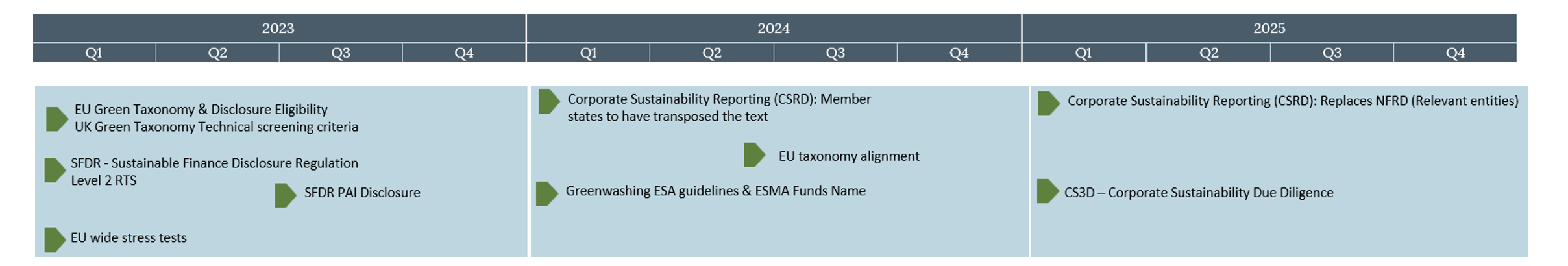

The next few years sees a raft of new regulation being released that will impact both corporates and financial institutions.

1. A lack of standardisation

Which framework should be applied?

The initial challenge around ESG data that arises, prior to data sourcing, is understanding what precisely needs to be reported. This question alone can prove confusing and time-consuming, particularly for small and medium sized companies with limited resources. The absence of a standard approach can lead to confusion with regards to which frameworks to apply.

The number of ESG reporting frameworks that have been developed by regulators (for an explanation of the most important regulatory ESG frameworks (see An overview of ESG regulation for EU based financial institutions) and industries has grown significantly over the past three years. It is common that such frameworks frequently use varying definitions for similar concepts, further exacerbating the complexity. Even within a single framework, such the EU Taxonomy that is intended to serve as the sole 'dictionary' for sustainable activities, ambiguity persists specifically with regards to how to define ‘green’.

It is therefore unsurprising that different firms are applying different definitions and standards when reporting on ESG.

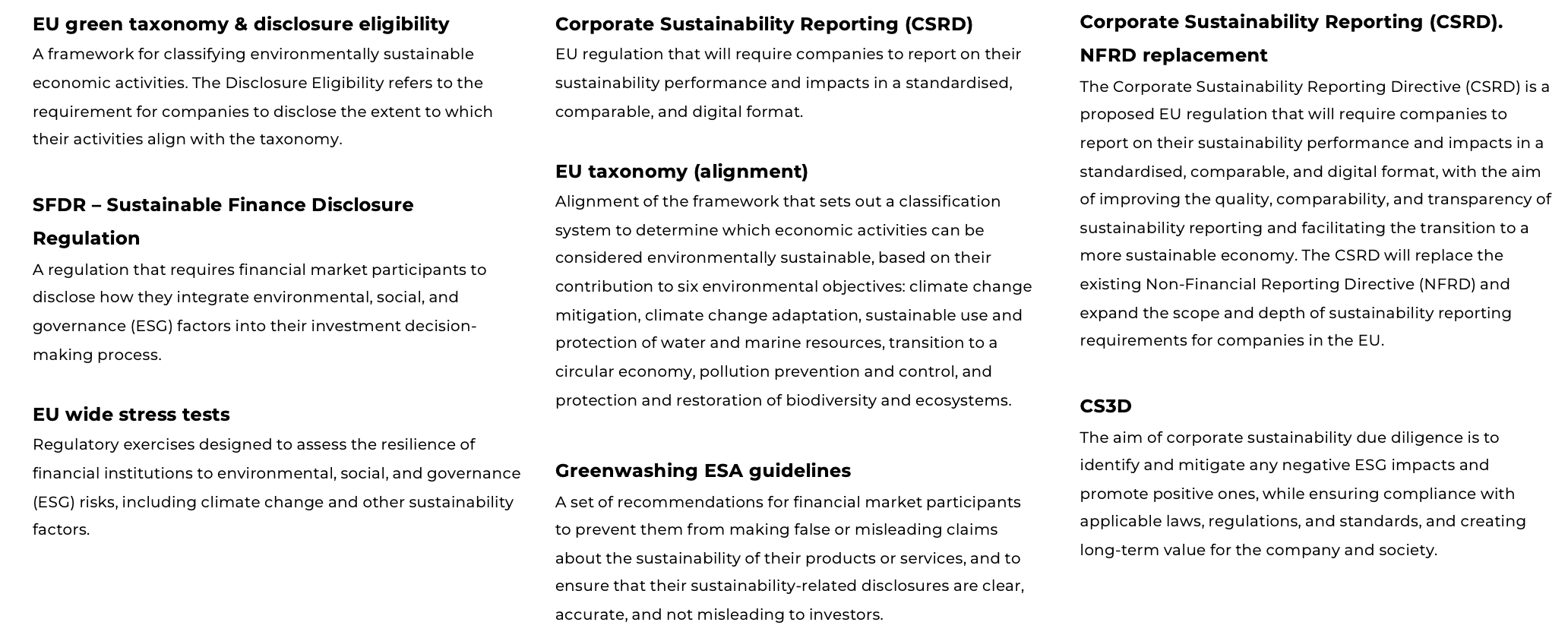

The utilisation of different frameworks, definitions, and KPIs across firms and institutions results in a significant problem for the users of ESG data, namely that the comparison of ESG data across companies is considerably more difficult.

Furthermore, requirements across different legal jurisdictions can vary and lead to conflicting or divergent data points used for similar purposes, making it even more complicated for institutions operating across borders.

This lack of clarity affects data collection as without clear definitions of ESG KPIs, collection of data can, at best, be inefficient and, at worst, be unable to take place or rely on the extensive use of proxying. It is therefore important that firms understand the existing reporting frameworks, initiatives and their requirements.

2. A lack of specialisation

General KPIs and simplified assumptions impacting the end result

When firms and institutions try to work out which metrics they need to report on, a second challenge arises with regards to the lack of specialisation of ESG data reporting.

The models and frameworks that are provided by regulators or external data providers often apply simplified assumptions and a generalised set of KPIs. This standardisation of assumptions and KPIs can decrease the value of ESG data for users, as firms in different industries will not experience the same materiality of risk for certain ESG risk categories. This imposes the risk that relevant information and nuances per industry or even per firm will not be reported. It is therefore desirable that these ESG risk categories with increased materiality undertake a more thorough assessment, tailored to the company and its industry.

This more specific and tailored form of ESG reporting is most beneficial for a firm's investors and clients (also taking into consideration the risk of greenwashing), rather than for the regulator, as the latter requires companies to report in a standardised form in order to be compliant.

3. Availability of data

KPIs rely on data that is often not yet captured or in existing systems

The availability of data is the third challenge. After deciding what the relevant ESG indicators entail, the organisation needs to identify the data required. Many companies find that these KPIs often rely on data that is not currently being reported. Moreover, even if firms report on their ESG performance, they often do so in an unstructured, narrative form, making it less useful for stakeholders who want to understand their value chain partners' ESG status in a consistent manner.

The next step is to determine how to handle the identified data gaps. Options to close these gaps include:

- Collect data directly from companies, via surveys, questionnaires, or other data collection methods. This approach may be time consuming and costly, but it can provide more accurate and detailed data if there are sufficient and complete responses.

- Partner with external ESG data providers, who may already have established relationships with companies and may be willing to share their data (most likely for a fee).

- Open data sources, such as government data or data from non-profit organisations, could be used to populate a database or platform where possible. This can be a cost-effective way to gather a large amount of data, but it may require more effort to clean and organise the data.

- AI, machine learning, and other technological solutions can also be used to analyse, interpret, and restructure data in order to fill data gaps.

Overall, using a combination of these solutions is advisable.

Though the availability of ESG data is limited in several cases, it is expected to improve with the imposture of more regulatory obligations over time for an increasing group of companies and institutions. For example, whereas in the Non-Financial Reporting Directive (NFRD) only listed companies were obligated to report on non-financial KPIs, this group is now larger due to the replacement of the NFRD with the Corporate Sustainability Reporting Directive (CSRD). The CSRD imposes ESG reporting obligations for large companies as well as listed companies. On top of these regulatory obligations, pressure from investors, supply chain partners and the general public will likely increase the amount of ESG data available over the coming years.

4. Reliability of data

Obtaining accurate data remains a challenge

The reliability of ESG data is also a concern. When reporting on the ESG-related performance of clients, investee companies, or other partners in the value chain, there may be instances where parties are reluctant to reveal specific ESG data or lack the necessary tools to track and report such information. This hinders the ability of investors and other stakeholders to obtain a comprehensive understanding of the company's ESG performance.

There are a few ways to address this challenge:

- The establishment of independent third-party verification of ESG data could help to improve the reliability of ESG data. Independent organisations could assess the accuracy and reliability of a company's ESG data, for example, by reviewing a company's ESG-related evidence documents or by conducting on-site inspections. This can be both time consuming and costly, however, a suitable business case could be built. The downside is that when data gaps are filled by third-party ESG data vendors, these external parties are not always transparent in, or willing to share, the methodologies that they use.

- Companies could also improve the comprehensiveness and transparency of their ESG data by working to increase transparency in their supply chains. This can involve implementing programmes to assess and monitor the ESG performance of suppliers and disclosing this information to stakeholders.

- Collaborating with industry peers could also be an avenue to facilitate the collection of information from common suppliers.

5. Different needs for different data users

The need to report in different formats to different parties further complicates matters

A final challenge relates to the transformation of data into useful reports. There are several consumers of ESG data reports, that can be categorised into regulators, investors, clients, and supply chain partners. The challenge is that these stakeholders may be interested in different aspects of ESG data and may request varying levels of detail across different data points and topics. At the same time, not all data points included in questionnaires from investors, partners, or regulators are relevant to all companies and firms fear repercussions for leaving such fields blank, despite attempting to address the issue with providers or investors.

On the firms' side, the integration of ESG data must advance rapidly to meet the growing demand from investors for accurate and transparent data that feeds into investment decisions, especially as investors are a key user group who are increasingly wary of greenwashing.

Incorporating ESG considerations into a company's operations should not be limited to creating a new non-financial report. Given the variety of stakeholders interested in ESG data, firms should not only adopt a minimal compliant approach but also ensure that ESG is embedded in the strategy of the firm.

This involves comprehending the factors that generate value for the organisation and enabling business insights to manage sustainable growth in the long run.

The road ahead

Overall, sourcing reliable ESG data for companies is a complex and evolving challenge. While progress is being made to standardise and improve the quality of ESG data, more work is needed to ensure that relevant information is widely available and easily accessible to all interested parties.

NextWave is well-equipped to help financial institutions tackle the challenges of ESG data through our partnerships with innovative technology firms like Quantexa and Knight Analytics. By working together with these partners, we can help clients gain valuable insights into their ESG data and understand their value chain better. With our data-driven approach and expertise in ESG consulting, we can provide tailored solutions to address specific challenges and help optimise ESG performance. Our team of experienced consultants can help clients navigate the complex landscape of ESG data and reporting requirements and provide customised solutions that meet their unique needs. With our collaborative approach and cutting-edge technology, we can help financial institutions stay ahead of the curve in ESG reporting and analysis, resulting in a positive impact on their bottom line and the environment

Interested in digital acceleration?

Subscribe to NextWave for occasional email updates on the latest technology, acceleration approaches, news and NextWave events. You can unsubscribe from these communications at any time.

Subscribe for our latest updates

Tags:

Sustainable Finance

May 31, 2023