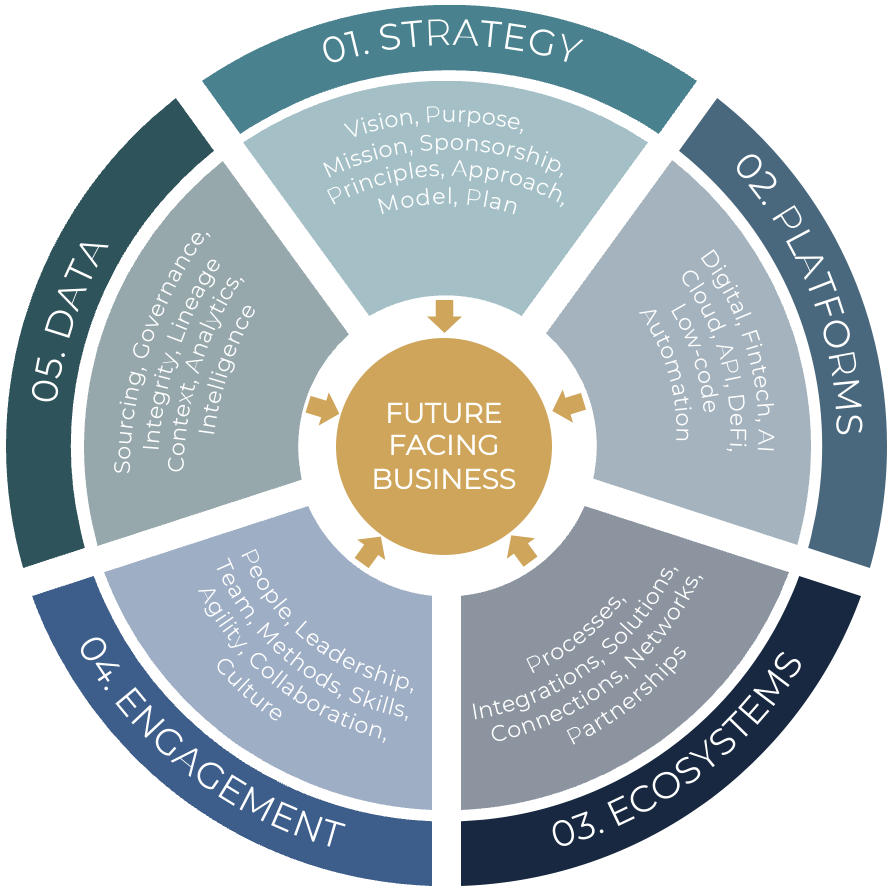

Strategy

A strategic approach is required to achieve transformational change in your organisation. Investment in developing your strategy up front paves the way for successful execution.

Platforms

Modern technologies offer not just power, scale, automation and AI capabilities, but also the opportunity to develop new systems and processes at a pace that far outpaces legacy approaches.

Engagement

People are the backbone of an organisation, driving its growth, innovation, and success. Focus on skills, culture and ways of working to harness human potential & drive successful business evolution.

Ecosystems

We operate in a connected online market and the firms that successfully foster & leverage their networks of clients, products, processes, partners, people, platforms and solution providers will get ahead.

Data

Data is the fuel for all your key business processes and systems. Sourcing, governing, enhancing and leveraging enterprise data to drive intelligence, decision-making and business value is vital.

.png?width=700&height=153&name=synthesized%20(1).png)

.png?width=120&height=60&name=Celonis_Logo%20(2).png)

.jpeg?width=150&height=70&name=PIMFA%20logo%20600x600%20(1).jpeg)