Artificial Intelligence (AI)

Redefining the possible

AI for Business Transformation

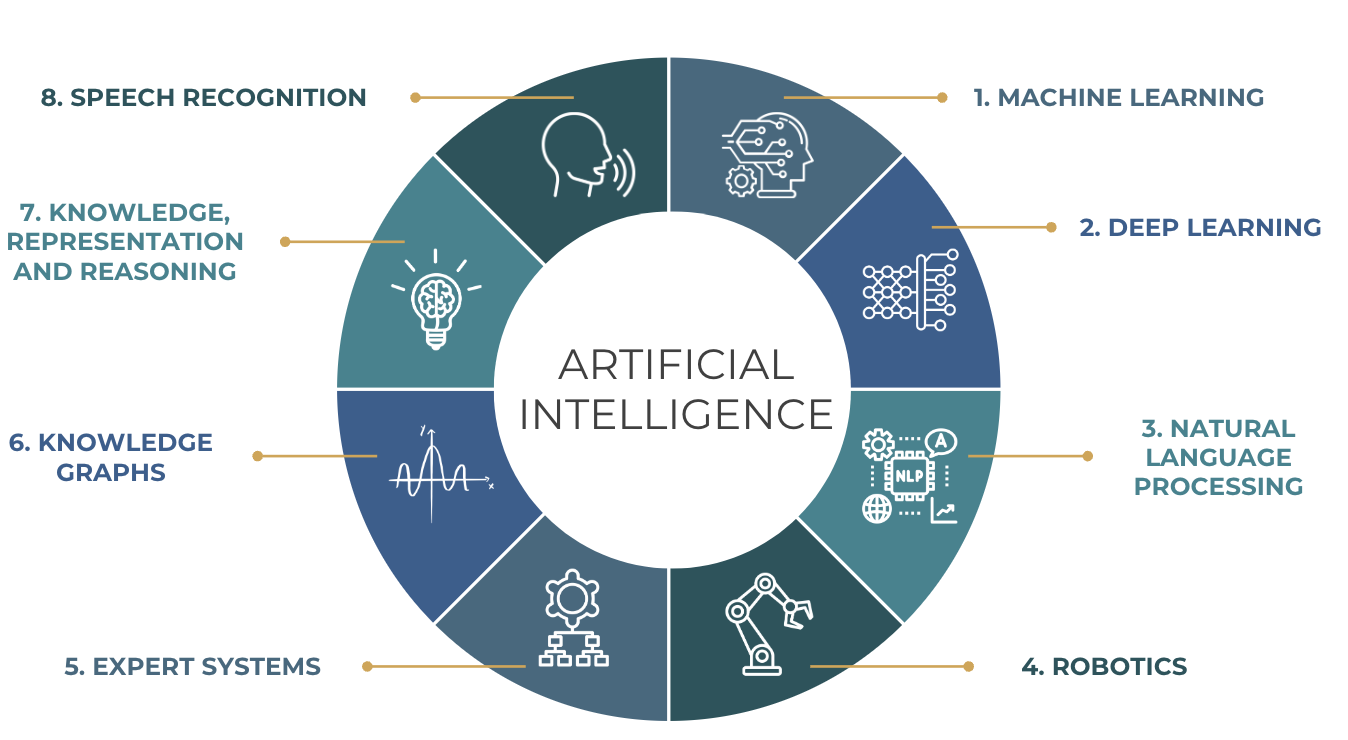

AI, or Artificial Intelligence, encompasses a suite of technologies designed to replicate human cognitive functions, such as learning, problem-solving, and decision-making. It holds the promise of enhancing efficiency and precision across diverse sectors while streamlining costs and expediting processes. The term 'AI' serves as an umbrella for a myriad of methodologies and techniques, from machine learning algorithms and neural networks to natural language processing and robotics.

Generative AI, together with Automation technologies has the potential to transform efficiency, precision, and cost-effectiveness at enterprise scale. NextWave's focus on driving business outcomes for our clients, powered by the latest technologies and our collaborative ecosystem, is pioneering the integration of AI into financial solutions.

The landscape is evolving; industry giants like Microsoft and Google are democratizing AI through user-friendly platforms like ChatGPT and CoPilot, amplifying visibility and accessibility. This new wave of innovation is bringing the power of AI directly to every area of the business.

Generative vs Non-generative AI

Transforming industries with AI:

From enhancing customer experiences to streamlining operations and decision-making, there are many potential use cases to consider that can bolster customer engagement, optimise operational efficiency and strengthen controls.

Fraud detection & prevention

AI algorithms can analyse transaction patterns in real time to identify and prevent fraudulent activities, reducing financial losses and protecting customers. Machine learning models, especially anomaly detection systems, are used to identify patterns and outliers that may suggest fraudulent behaviour.

Process automation

AI streamlines back-office operations, such as account opening or claims processing, by automating routine tasks and paperwork. Robotic Process Automation (RPA) is widely used for automating repetitive tasks, not only in finance but also in sectors like manufacturing, healthcare, and retail.

Risk Management/ Credit Scoring

Machine learning models offer more sophisticated and accurate credit scoring by analysing traditional and non-traditional data sources, leading to better lending decisions. Supervised learning techniques are applied to analyse credit history, transaction data, and even alternative data to predict creditworthiness and other risk levels. AI is increasingly being used to assess risk more accurately across portfolios, identifying potential issues and suggesting mitigation strategies quickly.

Customer service automation

Chatbots and virtual assistants powered by AI can handle customer inquiries and transactions, providing 24/7 service without human intervention. Powered by NLP for text interaction and voice generation AI for automated voice services can handle a range of customer service tasks.

Anti-Money Laundering (AML)

AI systems improve the detection of suspicious activities and help in the efficient analysis of data to prevent money laundering. Machine learning and NLP are used to analyse transaction data and customer communication for patterns that might indicate money laundering activities.

Document automation and analysis

NLP and image recognition technologies are used to digitise, categorise, and analyse documents for faster processing and decision-making. Extensively used in areas such as customer onboarding, processing large volumes of legal documents, invoice processing, medical records translation, and many other areas that are heavily reliant on paper documentation.

Regulatory compliance (RegTech)

AI helps in monitoring and ensuring compliance with regulatory requirements by automatically updating systems in response to regulatory changes and detecting non-compliant behaviour.

Personalised banking

AI enables the delivery of personalised financial advice and product recommendations to customers based on their behaviour and preferences.

Investment strategy

Increasingly investment firms are using sentiment analysis to gauge the public's perception of various stocks, market conditions, or the overall economy. By analysing vast amounts of data from news articles, social media posts, financial forums, and blogs, the firm's AI system can determine whether the sentiment around a particular company or sector is positive, negative, or neutral.

-2-1.png?width=1546&height=631&name=Untitled%20design%20(4)-2-1.png)

Case Studies

Our clients have accelerated development cycles and transformed their operations using AI driven automation solutions.

Before and after automating a heavily manual process using Appian

Re-insurance Finance And Operations automation with Appian

Automation of Collateral Call processing

Our AI focus areas

Financial organisations are leveraging AI to automate mundane tasks, liberating resources for strategic initiatives. Our integration of Appian, Alteryx, ServiceNow and Quantexa technologies ensures rapid business transformation. By harnessing these tools, we empower organizations to navigate complexities with agility, driving efficiency and fostering sustainable growth in the dynamic financial sector.

Data Management & Analytics

AI Centre

of Excellence

AI automation

Enterprise AI

Playbooks

NextWave AI Perspectives

Focus your strategy, set your plan and modernise your business

Our experts

With decades of experience in top-tier financial services institutions and fintechs, our AI leaders deliver successful strategy plans and transformative business solutions for our clients. From risk management to customer experience enhancement, our team's deep expertise drives growth by leveraging cutting-edge AI technologies tailored to your organisation's unique needs.

Interested in digital acceleration?

Subscribe to NextWave for occasional email updates on the latest technology, acceleration approaches, news and NextWave events. You can unsubscribe from these communications at any time.

.png?width=100&height=52&name=Appian_logo(3).png)