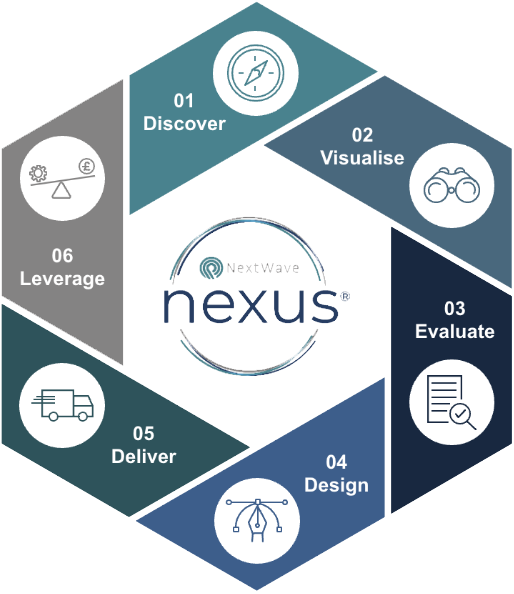

Discover

Rapidly identify current state – business objectives/pain points & opportunities, stakeholders, organisation, processes, data, technology.

Visualise

Definition of target state business footprint, capabilities and requirements, business targets & KPIs, solution concepts & roadmaps.

Evaluate

Identify, evaluate & choose from business case & solution options, deployment approaches, service designs & implementation plans.

Design

Business case & delivery plan detail – services, solution, technology, data, operating model detail architecture & design.

Deliver

Service & product build – data, application and infrastructure integrations & testing. Deployment & operation.

Leverage

Benefits realisation & KPI measurement. Backlog and next phase opportunity review & prioritisation. Lessons learnt. Communicate & leverage.

.png?width=1200&height=627&name=Appian_logo(3).png)