Regulatory horizon scanning is a process of monitoring and analysing emerging regulatory developments that could impact an organisation's operations or industry. This involves keeping up-to-date with regulatory changes, upcoming legislation, and policy initiatives, and analysing the potential impact on an organisation's compliance obligations, risk exposure, and business strategy. The goal of regulatory horizon scanning is to anticipate and prepare for changes in the regulatory environment so that an organisation can adapt and stay ahead of the curve. This can help organisations to mitigate risks, seize opportunities and maintain compliance with regulatory requirements.

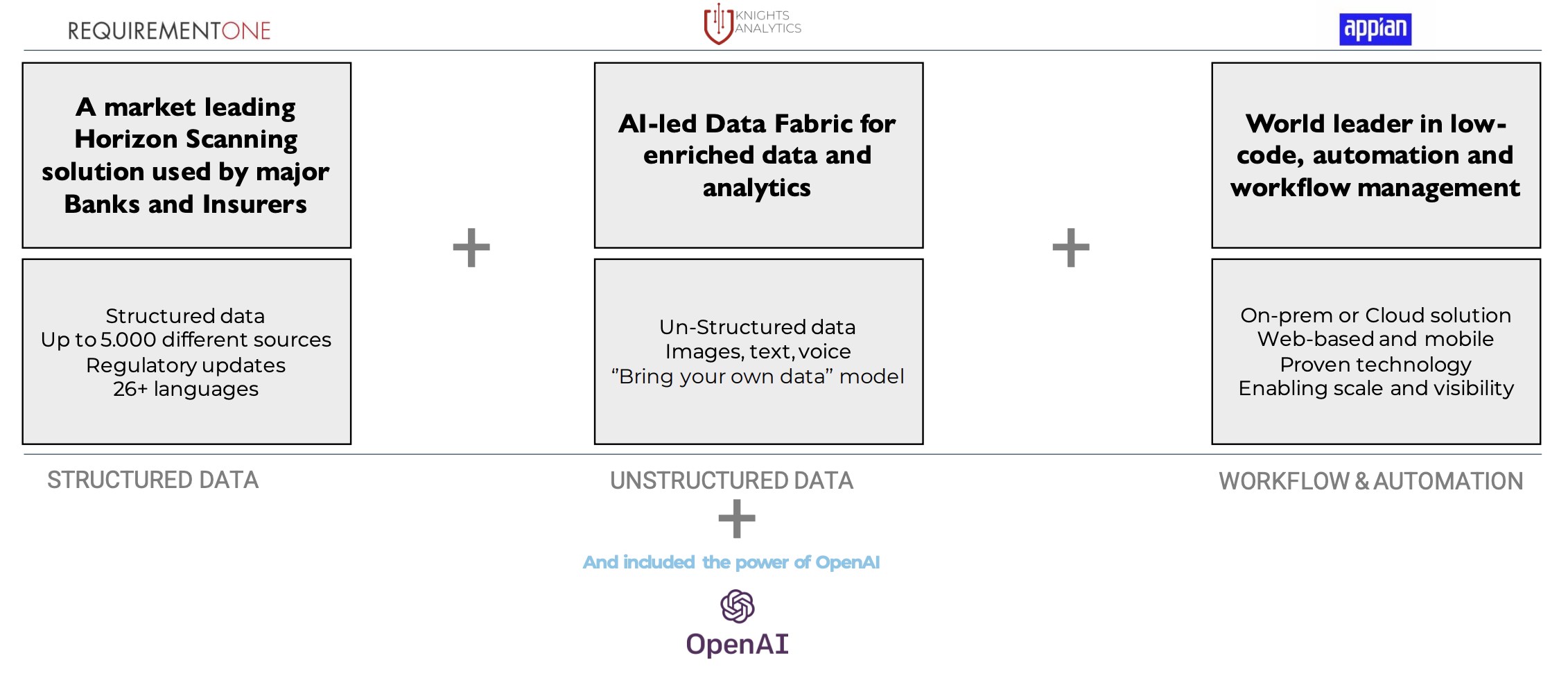

Working with Knights Analytics, Appian & RequirementOne , we have designed and developed an AI powered solution using structured, unstructured data and best in class workflow tooling. By leveraging technology solutions to automate and streamline their regulatory horizon scanning efforts, organisations can stay ahead of the curve and adapt quickly to regulatory changes, reducing the risk of non-compliance issues and fines.

The cost of compliance continues to rise

$50BN

$10,000

Key benefits that technology can provide

- Scalability: Technology can enable organisations to scale their regulatory horizon scanning efforts by automating the process of monitoring regulatory developments. This can help organisations keep up with the volume and complexity of regulatory information and identify new regulatory requirements in a timely manner.

- Efficiency: Technology can automate many of the repetitive tasks associated with regulatory horizon scanning, such as searching for relevant regulations and analysing their implications. This can save time and reduce errors, freeing up resources to focus on more complex tasks.

- Accuracy: Technology solutions can help organisations to ensure that they are capturing and interpreting regulatory information accurately, reducing the risk of missed or misinterpreted regulations that could result in compliance issues.

- Speed: Technology solutions can help organisations to quickly identify and respond to regulatory changes, reducing the time between when a new regulation is issued and when the organisation becomes aware of it. This can help Organisations to stay ahead of the curve and adapt to new regulatory requirements more quickly.

- Intelligence: Technology solutions can provide organisations with insights into emerging regulatory trends and patterns, helping them to anticipate future regulatory changes and prepare accordingly. This can help Organisations to be proactive in their compliance efforts and avoid compliance issues before they arise.

- Cost savings: By automating regulatory horizon scanning, organisations can save on staff costs associated with manual monitoring and analysis of regulatory developments. Additionally, by identifying regulatory requirements early on, organisations can avoid costly compliance issues that could result in fines, penalties or legal fees.

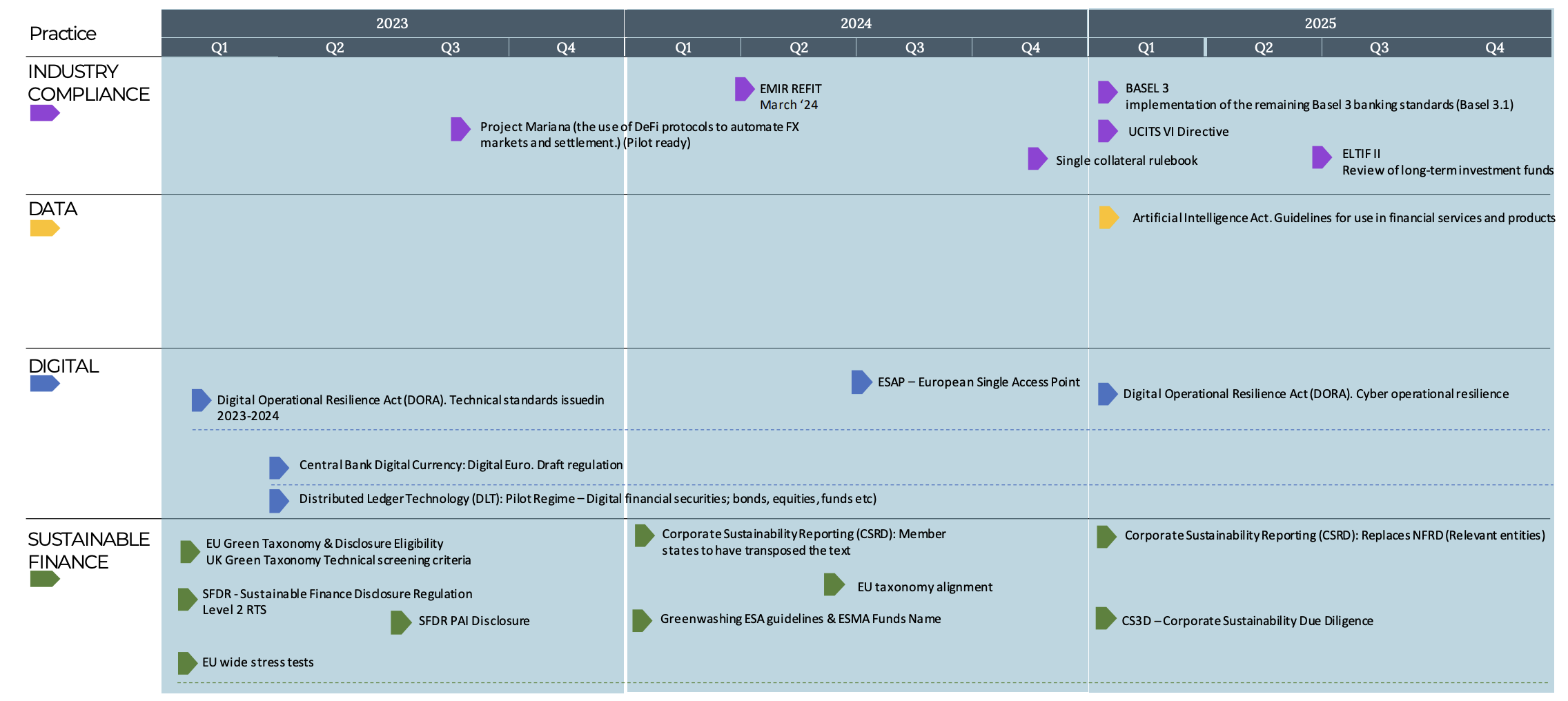

What's coming next in European regulation 2023?

Some of the key challenges

- Volume and complexity of regulatory information: Regulatory landscape is vast and complex, with various authorities

issuing regulations that can impact a business in multiple ways. The volume of regulatory information can be

overwhelming, making it difficult to keep up with the latest developments. Moreover, the information can be highly

technical, legalistic, and opaque, which may require a specialist to interpret and analyse the implications for the

business. - Multiplicity of regulatory authorities: Regulatory authorities are often separate entities with different mandates, jurisdictions and timelines for issuing new regulations. This can result in a patchwork of regulations that can be difficult to navigate and understand. As a result, businesses must monitor multiple authorities simultaneously, each with their own unique requirements, making horizon scanning a time consuming and resource intensive task. In addition, some European regulations will be mandatory to implement, whilst others may be subject to a local ‘opt out’.

- Speed of regulatory change: Regulations are constantly evolving, with new rules, standards and requirements being introduced frequently. This rapid pace of change can make it challenging for businesses to keep up with the latest developments, especially if they lack the resources or expertise to monitor and analyse regulatory developments.

- Uncertainty and unpredictability of regulatory change: Regulatory changes can be unpredictable, and their impacts on businesses can be difficult to foresee. This can make it challenging for organisations to plan and prepare for the future, leading to uncertainty and potential exposure to regulatory risk.

- Lack of centralised and automated regulatory horizon scanning systems: Many organisations rely on manual processes or ad hoc systems to monitor regulatory changes. This can be inefficient and prone to errors, which can lead to missed regulatory developments or delayed responses.

Ultimately without a centralised and automated regulatory horizon scanning system, organisations may struggle to keep up with

the pace of regulatory change and stay compliant.

How can these challenges be resolved?

Our clients are asking how they can tackle these challenges, and how we can use technology to help them resolve the issues they are facing. To address these challenges, organisations can take several steps to improve their regulatory horizon scanning capabilities:

- Establish a regulatory horizon scanning team: By dedicating a team or a person to monitor regulatory changes and analyse their impacts, organisations can ensure that they have a specialised focus on regulatory compliance and risk management. This team can be responsible for monitoring regulatory developments, interpreting their implications and providing regular updates to senior management.

- Develop a regulatory landscape map: A regulatory landscape map can help organisations visualise the regulatory environment they operate in, including the relevant authorities, their mandates, and their timelines for issuing regulations. This can help organisations to prioritise their monitoring efforts and identify potential gaps in their regulatory compliance.

- Leverage technology solutions: There are many technology solutions available that can help organisations automate regulatory horizon scanning, such as AI, machine learning, and natural language processing. These tools can help organisations to sift through vast amounts of regulatory information and identify the most relevant developments for their business.

- Engage with regulatory authorities: Engaging with regulatory authorities can provide organisations with insight into their plans for issuing new regulations and their interpretation of existing rules. This can help organisations to anticipate regulatory changes and prepare accordingly.

- Foster a culture of regulatory compliance: Regulatory horizon scanning should be a shared responsibility across the organization, not just the compliance or risk management team. By fostering a culture of regulatory compliance, Organisations can ensure that all employees are aware of the regulatory landscape and are actively engaged in monitoring and responding to regulatory developments.

Our response

We have combined three of our partners technologies to create a new 'accelerator’ solution to help our clients tackle their regulatory horizon scanning challenges.

Interested in digital acceleration?

Subscribe to NextWave for occasional email updates on the latest technology, acceleration approaches, news and NextWave events. You can unsubscribe from these communications at any time.

Subscribe for our latest updates

Tags:

Regulatory & Compliance

May 23, 2023