How ESG related decisions will drive the future of finance

Perspectives / How ESG Will Drive The Future Of Finance

2021 saw a raft of new regulation and commitments focused on the environment

In 2021, governments from around the world took further small steps to try and limit global warming to below 1.5C. Whilst it is commendable to promote and support such an idea, policies and recommendations can only be enforced with the help of the finance sector. As with the so called war on financial crime, banks and financial institutions are already being placed right at the heart of this new sustainable agenda. Whilst banks themselves can argue that they have a sustainable footprint, it is their clients that are the problem, and specifically what their clients do with the money that is lent to them. As such, it will be the banks that will be asked to source data and report on the sustainability of their loan portfolios, and it will be the banks that will be told to reduce certain types of lending to and restrict funding to companies that are impacting the environment with their activities.

Promises made at COP26

On day 4 of the Glasgow climate summit the focus was on Finance. The key take-aways were:

A $130trn number. This number captures the fact that the institutions controlling $130trn of financial assets have signed up to meet the 1.5C target for global warming. The institutions included investment managers, pension funds, banks and insurers. There are roughly $300trn of assets in the world, so this number represented about 40% of global assets.

A $100bn number. This number was agreed in 2009 and represent the amount of financial support that rich countries are supposed to provide annually to poorer countries. So far this goal has not been met, with approximately $80bn provided in 2019 and a similar number for 2020.

At COP26 good progress was made on improving the contributions and a good example of what we are likely to see more of is the deal announced to help South Africa transition to clean energy.

In Europe the Bank Of England and The ECB are already driving climate-focused stress testing activities

The impact on a bank's portfolio: What we already know

Climate change is going to be wide-ranging and have a major impact on financial institutions and their customers. We expect an ESG (Environmental, Social & Governance) lens to have to be applied to activities within the bank, starting with reviewing what has already been lent, and moving quickly to the strategy as to what should be lent in the future and what needs to be exited as soon as possible.

The quality of the portfolio also needs to be looked at in a different light. Agricultural heavy loan books, previously deemed environmentally sound, have now been thrown into the spotlight, as governments are looking at methane produced by cows as one of the major causes of the rise in global temperatures. Whilst the on-going climate focused stress tests are struggling with an array of new data requests (we estimate at least 100+new data sources may be required) to accurately complete the new taxonomies, a number of banks have already identified key issues with their portfolios and have been taking steps to adjust their lending books, by divesting assets.

ING now has carbon emission reduction targets covering almost half (45%) of its €600bn lending portfolio, including 70% of its mortgage book, and is focused on aligning its global lending portfolio to net-zero by 2050 or before.

The loan book is just the start

Steps to divest assets, in a controlled fashion, certainly look like a step in the right direction. Institutions can promote themselves as doing the right thing and becoming more sustainable. On the other hand, there is a risk that such activities gain momentum and then create ”cliff” type scenarios for certain ”dirty” industries, as assets are dumped in a fire sale, something that governments will also be keen to avoid, as it could result in supply shortages and civil unrest.

The loan book review should not just focus on sustainability and climate impact. The data shows that if climate change is not kept under control, then Europe will be prone to severe climate-related events, such as mass wildfires and flooding.

Understanding such scenarios will be key to understanding the health of a banks portfolio when facing different scenarios. What happens for example to an institution that has lent heavily in the Italian mortgage market, but is based in France? What happens if there is a mass wildfire and extreme flooding that destroys properties and as such the mortgages on those properties become worthless? The contagion risk across the EU economies, as a result of one or more climate disasters is becoming real, and once it starts will be difficult to control.

Examples of the impact of climate change on a banks balance sheets assets will include:

- Mortgages: Credit risk increases. People lose their jobs or become displaced due to climate transition impacts or a climate-related event. Transition risk increases and impacts certain industries and locations, e.g. In Poland the number of coal miners reduces from 400.000 to 80.000, resulting in mass unemployment. Mortgages are no longer repaid and the ability to recoup losses based on the underlying collateral becomes harder to achieve, especially if the property has been flooded or damaged by fire.

- Securities/Bonds: A potential fall in value if issuing financial institutions suffer financial difficulties due to climate change issues.

- Derivatives: Valuation models will need to change to incorporate climate risks which could impact negatively on values.

- Physical Collateral: May be compromised due to climate issues. Additional consideration if the collateral is in a different country than underlying loan/position = wrong-way risk. Collateral brings additional risk rather than alleviating it (complexity in disclosures).

The impact is not just limited to assets, but also to liabilities:

- Corporate Debt: A potential lack of availability or increased cost.

- Derivatives: Valuation models will need to change to incorporate climate risk which could impact negatively on valuations.

- Deposits: Could be reduced if individuals or corporate income is impacted.

All of which could impact a banks capital position.

- Reserves: A potential deterioration driven increased losses driven by loan write-offs.

- Increase in the capital requirement: Due to a deterioration in the quality of collateral which will drive an increase in exposure at defaults.

- Liquidity: Will be negatively impacted due to defaults on loans payments and reduction of deposits.

- Funding costs Will increase due to a deterioration in the underlying balance sheet or collateral quality.

The focus for 2022

The rise in importance of complete and accurate disclosures

We expect more focus to now fall on mandatory disclosure. As the legal and regulatory frameworks fall into place, there will be an increasing emphasis on corporates and financial institutions to disclose their climate impacting positions. Within the financial sector we expect a lot more emphasis on SFDR ( Sustainable Finance Disclosure Regulation) reporting. We also expect more legal action when organisations do not accurately disclose or chose to not disclose at all. You can read more about the rise in litigation risk here.

Data quality & making the findings meaningful

Financial Institutions are facing a number of challenges in 2022. Whilst the Stress Tests are in full swing, providing accurate and meaningful results remains a challenge, both for the banks and the regulators. For those of us that have battled with large regulatory programs over the past twenty years, memories of ”proxying” values and providing data on a ”best efforts” basis will be revived. The need for standards, both in terms of content, format and from approved sources will become a critical factor in order to make the data provided meaningful and accurate. There is without doubt quite some way to go on this topic.

Getting more (& more) information from the client

As with the on-going Know Your Client (KYC) exercises, the need to ask for and source extensive amounts of data will only grow. Banks will be asking clients to identify not only what they are doing with the money that has been lent them, but also which parties are in their supply chains and what their suppliers are doing. KYC will quickly take on a sustainable lens, with KYS (Know Your Supplier) fast coming into focus.

Building effective & accurate climate-related models

As more data is gathered and more scenarios are modelled, there will be a need to further improve climate-related models, so banks and regulators can fully understand the impact of the data on their balance sheets and on the economy as a whole.

Driving strategy & the future of finance

With all of this data, the increasing regulatory pressures and the need to present a clean, green and sustainable image, we expect banks to continue to look to divest their interests in certain portfolios, as the race to ”net-zero” really begins to gather momentum.

The further growth in importance of finance focused groups

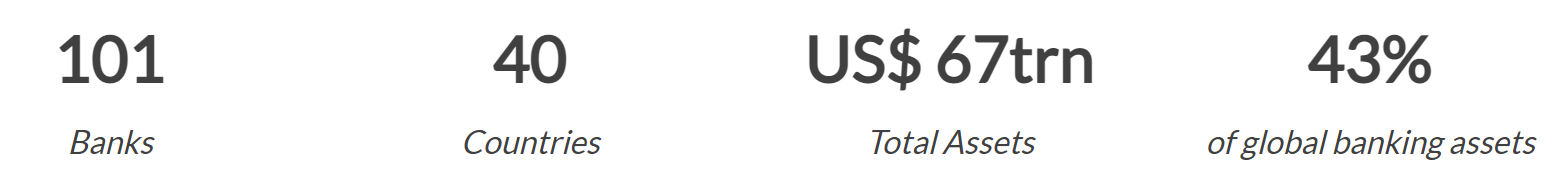

One of the most talked about movements is the Financial Alliance For Net Zero that is led by Mark Carney, who was the previous governor of the Bank of England.

We expect to see more and more financial institutions sign up to become members, with more than 100 financial institutions having already done so.

Interested in digital acceleration?

Subscribe to NextWave for occasional email updates on the latest technology, acceleration approaches, news and NextWave events. You can unsubscribe from these communications at any time.

Subscribe for our latest updates

Tags:

Sustainable Finance

January 18, 2022