Banks have endured a turbulent ride over the past 15 years. Markets have evolved, margins have been squeezed and regulation has dictated the terms of engagement (think mandatory clearing and mandatory reporting). Certain functions of the traditional global markets infrastructure, namely Fixed Income Securities, have remained largely unchanged. The US Securities Market is undertaking a necessary realignment of its Settlement Model (T+1). This is the context around Global Change programmes required to keep the lights on.

GSIB merger and integration approach

GSIBs are Global Systematically Important Banks. What is the most interesting aspect of GSIBs? Internal infrastructure has remained largely in place over the past 15 years. Roles have changed, primary locations have become slimmer, centres of processing excellence have swelled across cities in Asia, Eastern Europe and smaller cities and states within Western countries. By and large, this has been a consistent strategy across the majority of sell side firms and has enabled banks to build footprints across these locations, build feeders from local university campuses and delivered cost effective operating models to enable banks to offset the squeeze on margins. This has been a largely successful strategy so far, with no plans to do anything different yet (ChatGPT might well change that, but let’s not predict or hypothesise yet).

Roll the clock forward to April 2023, and we are witnessing and awaiting the ink to dry on the recent acquisition. Nobody has any insight into the strategy around how these 'big beasts' will move ahead and what will be earmarked for integration. People, Business units, positions, infrastructure? What will remain and be wound down over a period of time and what will be touted for immediate sale? The recent news around the merger will no doubt make for an interesting representation in the 2023 financials, but the most intriguing conundrum comes with the question, "how do we make the acquired business' pieces fit neatly, either quickly or over time, into a broader and deeper jigsaw?

Casting my mind back to 2000-2001, during my time at a global bank, I embarked on a truly global integration of the bank’s markets positions and trades onto another bank's infrastructure. The forensic analysis of activity, the need to dynamically manage down the hundreds of aged exceptions and reconciliation breaks, became pivotal, alongside our evaluation of both organisations' technology architecture and infrastructure. The steps we took, the extensive project plans we devised, the run-books we executed, not to mention the extensive front to back UAT and dress rehearsals we performed with precision, ensuring that every atom of activity was defined, scoped, tested and ultimately signed off to demonstrate success.

We worked every weekend for months to achieve our goal, and when the go-live weekend arrived, we knew we were prepared and confident we could deliver. We liaised with our new colleagues, typically in other regions, we adapted our schedules to fit the time zone challenges, we kept our phones permanently on (no Teams or Skype in those days) to talk dynamically with our colleagues, evaluating and discussing progress/issues as they arrived. iIt was frantic with information overload, but it worked. The communication across the programme was exceptional. We uncovered, fixed and documented our findings, and then we sprinted to the next stage.

No doubt, each business needs to have clarity, but there is often such complex inter-connectedness within GSIB’s that each business needs to be forensically analysed through multiple lenses to assess what they want to achieve. For example, trading books/desks /business Units consist of multiple Asset Classes which can expose challenges when transferring positions and trades if the strategy is to integrate at an asset class level. If the risk platforms are not consolidated, then this creates issues within Front Office and Finance, with the need to create synthetic risk positions to centralise activity into a single data store.

If we examine the previous offshoring strategy, it seems to work in a BAU (business as usual) construct, but do these functionally aligned verticals possess the deep business knowledge and the front to back prowess to integrate and possibly migrate tens of thousands of positions, hundreds of thousands of open trades, and 2 of the biggest challenges? What do we do with the matured and failing trades, without forgetting that approximately 60% of trading book volumes which exists within GSIB’s are trades booked to reflect Inter-company (intermediated) activity.

The true litmus test to successfully demonstrate the wind-down/closure of a GSIB’s primary legal entity resides with the substantiation of Bank Balance Sheet accounts (i.e. the general ledger accounts, representing, in their simplest form, the presentation of Asset Market Value, Open Payable/Receivable balances and the representation of ‘realised/settled cash’, which is typically managed within a Treasury Cost Centre, and not at the more granular Business Unit level. It is true that accounting entries are posted, reversed, reclassed and reclassified. It is also true that the vast majority of accounting entries are systematically generated through Accounting Engines, containing deep and complex rules, coded and understood by IT developers who moved on or left the organisations years ago.

The Back Office Control/Finance teams who perform the month-end sign-off process consider successful sign-off and substantiation as merely managing by exception, without the appreciation of evaluating the concept of a true cash reconciliation or implementing scenarios which review the ‘close-down’ position of a Legal Entity set of account and the appreciation of a race to the bottom. Forensic evaluation is no longer deemed to be a core control either on a day-to-day or month-end close basis.

If all positions and trades were off-loaded, would the Bank Nostros (Bank Accounts) be fully explainable, or would there remain the accumulated Life to Date P&L, generated over the years, which by design, has already been hedged out to the Bank’s Ledger ccy, so that even applying any residual would need to be approached with a ‘wow’ factor, of who/which business line is going to get the residual cash, or inadvertently, have to stump up the cash to clear down the shortfall? Or is this just to be left in the hands of the Bank Treasury Division to work out?

Years of industry reconciliation platforms have existed, but none have fundamentally questioned this, probably because no bank would ever want to predict the need to have it, but it does raise questions about how truly under control are all those Back office organisations, all mandated to understand, reconcile, substantiate and sign off each account balance and reflect and attest to the accuracy of the Bank’s books and records.

What should you consider during each merger phase?

There are a number of considerations that need to take place from the pre-merger, execution, and post-merger phases.

The word "strategy" is banded around quite loosely. CEOs and Boards need to consider the overall focus of the combined Organisation. Important answers await the industry and the employees working within them. Leaders of functional and divisional parts of the organisations will be set the task of devising the execution strategy, and given a hard date in which to implement. This isn’t another multi-year global Programme, where slippage is accepted and scope de-prioritised. The Mandate is clear, could the last person out, please turn off the lights!

As we get into the implementation of the integration, the next key area of consideration is the operating model. Essentially, a clearly defined operating model must detail legal entity structures, organisational structure and translate the strategy into implementation. This will include consolidation of financial reporting.

In addition, cross-divisional requirements and ongoing regulatory obligations need to be carefully consolidated. Data is probably one of the most important areas of integration planning due to heightened regulatory environments. SMCR, MiFID, EMIR 2, CFTC re-write, CRD6, to name a few, are all dancing around the Global Markets businesses, and while you wait, you’re in the cross-hairs. To some extent, while you’re at home, you still need to pay the bills! The businesses now deemed as non-core/ring-fenced and not part of any integration strategy still need to conform and comply. The IT developers are still needed, the Business Analysts and Project Managers are still required, and the Risk and Control Frameworks still need to be devised, enhanced and proved effective. For how long, nobody knows.

An additional consideration around business integration, requires the understanding of the multi-tenant platforms used ie: whether you trade bonds or equities as a primary activity or as a hedge or liquidity enabler, you pay to play alongside other global business units. If some, or most of these businesses are soon to find a new home, in the new combined organisation, and in a new platform, what does it mean for your business if you now have to pick up the cost of being the last person standing?

To answer this question comes back to creating a clear strategy within a certain time-frame. Is it cost effective to keep going with what you have, or possibly look to implement an off-the shelf platform, which will better represent the smaller business capabilities and volumes? The benefits are quite obvious. Eliminate the legacy spend, remove the dependency on continued support/development costs and look to the market for a short to medium term solution. There’s real merit in thinking about this early on.

Data strategy will also require deep minds and robust outcomes. How to consolidate, unify, translate and transpose the millions of lines of trade data, reference data, employee data and finance data, not to mention risk data and metrics. This can explode even the most data savvy people working within these organisations. To do this on a wholesale level is an enormous task, but joining the data dependency models together to grasp the eco-system for each component of the business is a statement that is simply 'too big to decipher' – it will undoubtedly force business leaders to have sleepless nights. It’s not impossible, it just needs time and a very specific number of data analysts to build, consume and then attempt to lay out the picture.

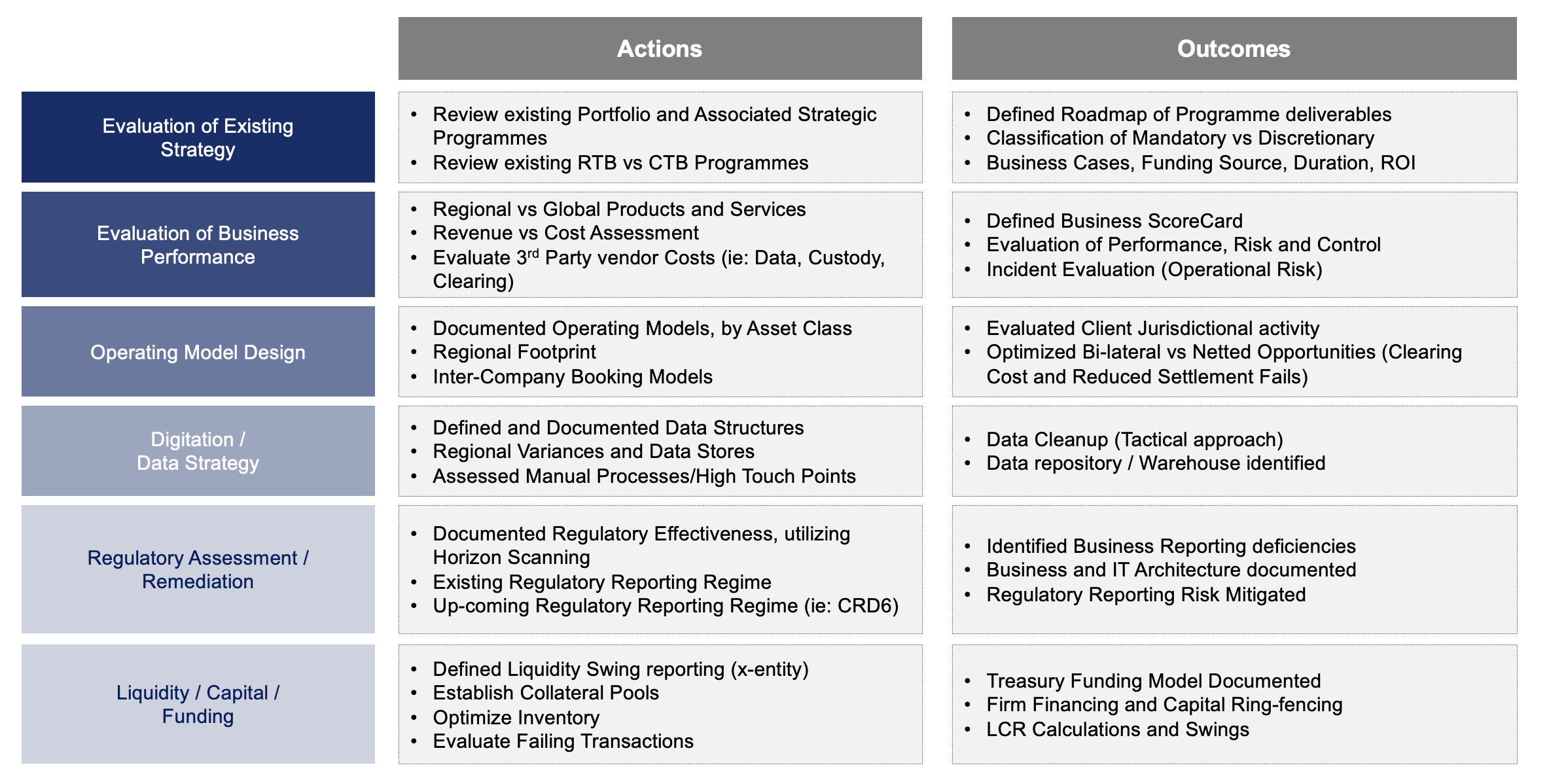

Pre-merger approach

Ensuring your organisation is 'factory ready'

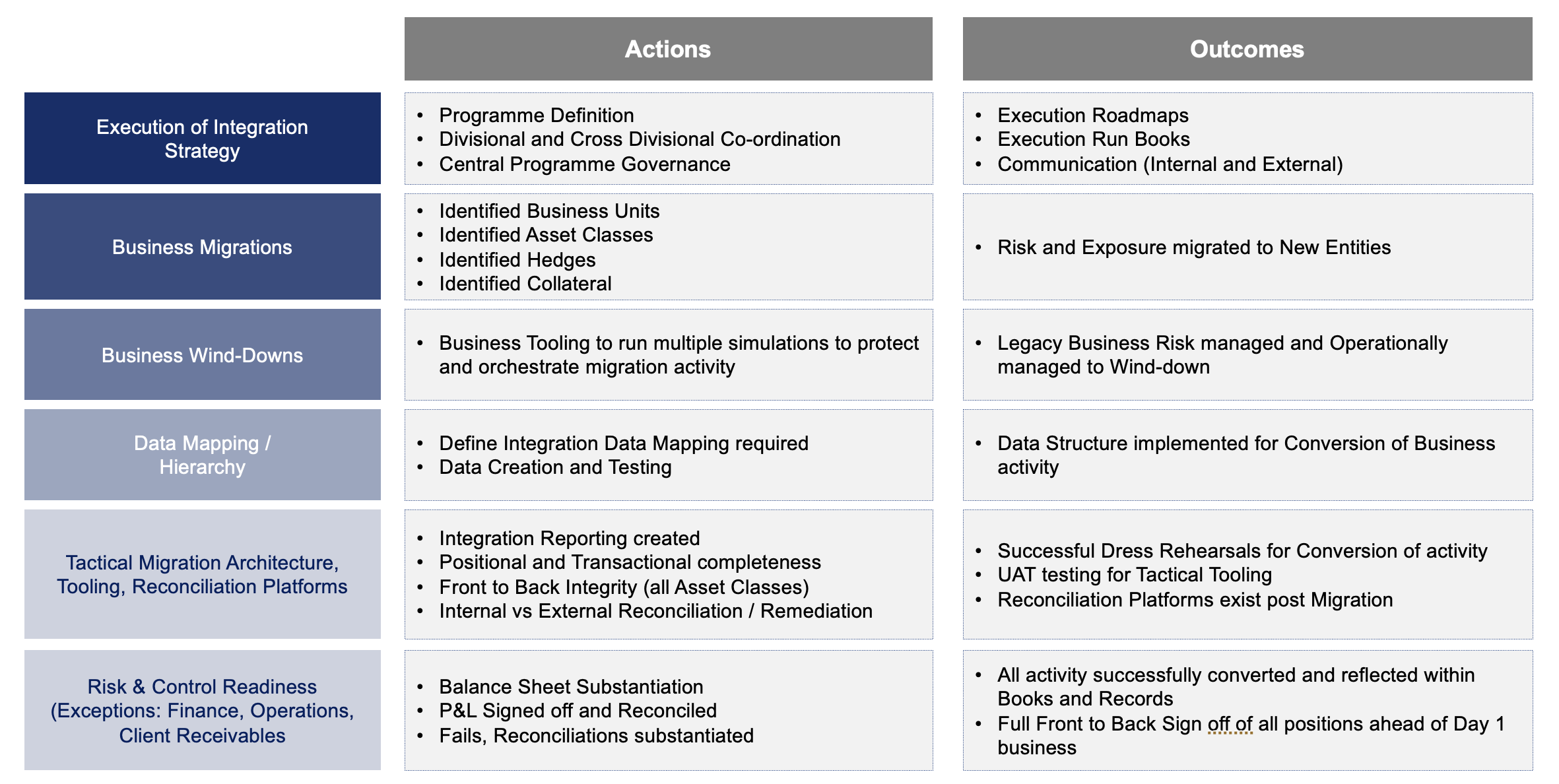

Integration approach

Ensuring your approach is 'integration ready'

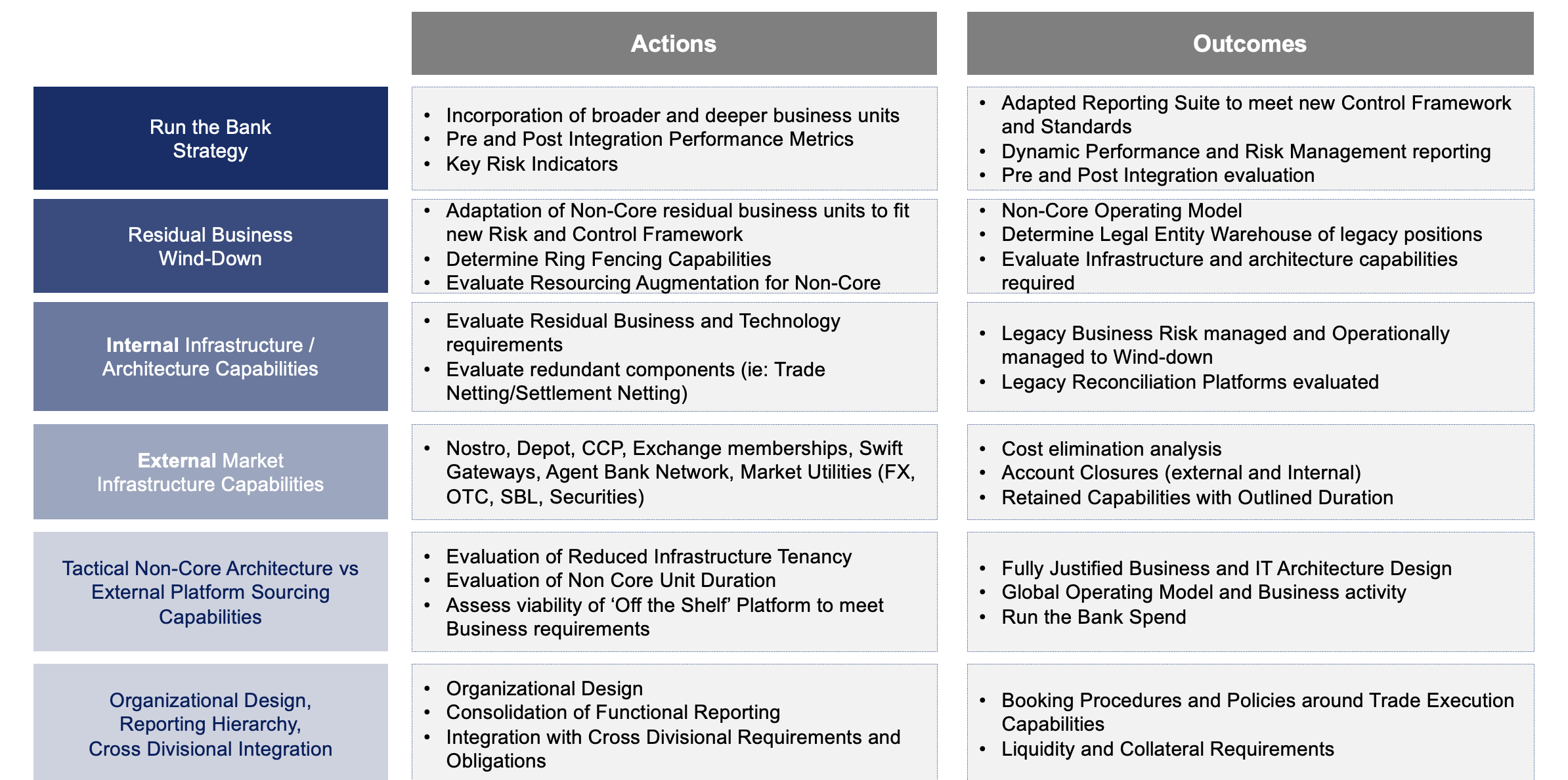

Post integration stabilisation

Ensuring your organisation is ‘operational, robust and controlled’

Conclusions

To conclude, never has there been a more important time to work in a Business and IT Change Management function, and to be part of an exciting and challenging opportunity. To unpick, document, plan, propose, manage, execute and implement such a critical and fundamental problem is akin to dismantling a 300 year old fully working palace. Is it ripped apart slowly and carefully, room by room, picking up important debris? Or is it reverse architected with thought and careful consideration and planning to uncover interesting aspects and avoid a huge catastrophe. Either way, it will take time and meticulous planning and execution.

Tags:

Strategy

May 24, 2023