Anti Money Laundering (AML)

Reveal hidden risks and detect criminal activity faster

Anti Money Laundering in context

Reduce false positives to manage the cost of compliance. Improve investigations to make faster and more consistent decisions at scale.

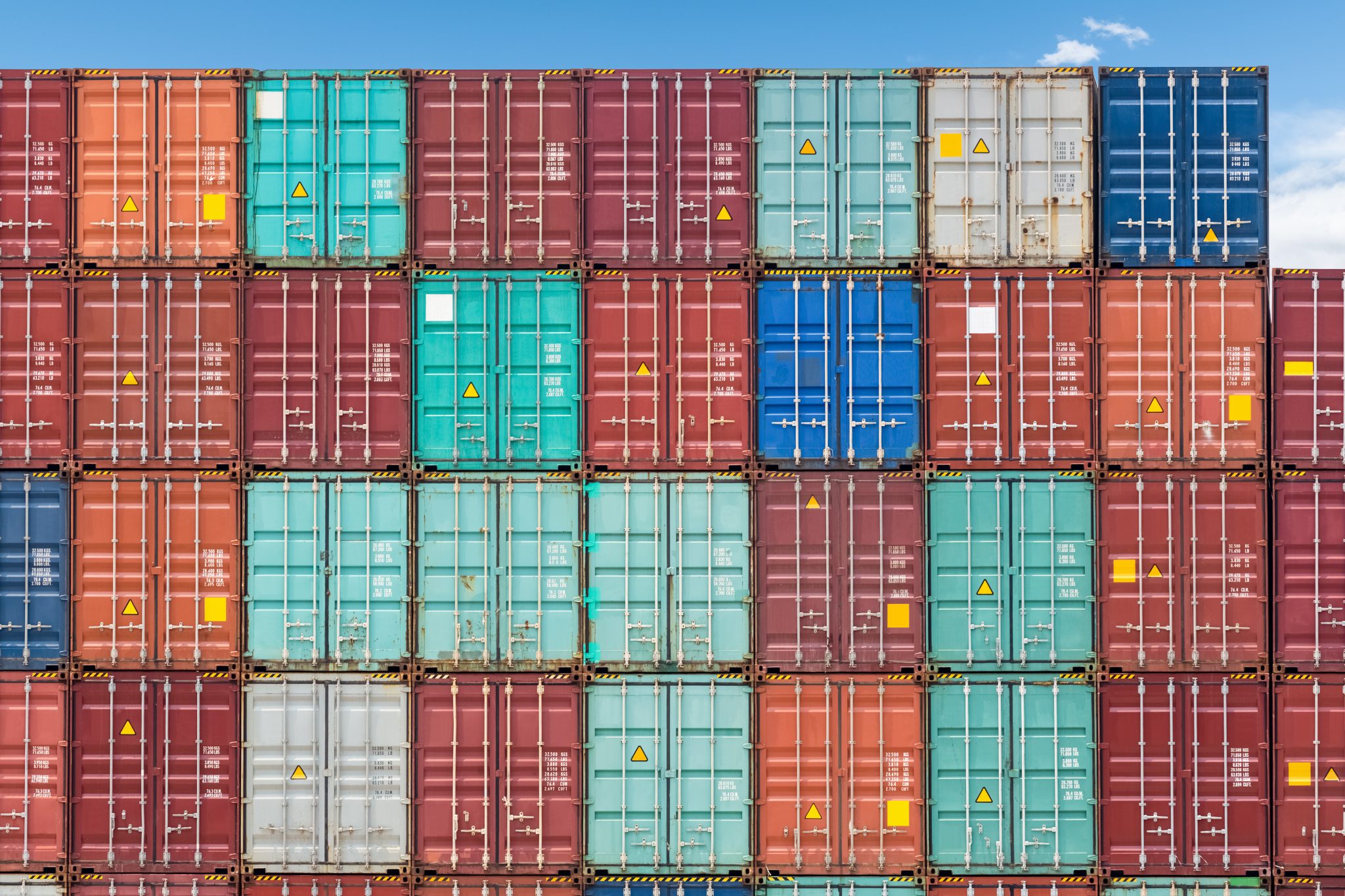

Trade AML

Traditional monitoring systems can’t handle the scale

Existing transaction monitoring systems produce thousands of false positives so your team has to manually process paperwork to uncover real risk.

Money laundering fuels horrendous crimes

Trade-based money laundering is more than evading import duties or currency restrictions. It’s used to move corrupt funds, enable human and wildlife trafficking, and smuggle weapons.

Markets AML

False positives are hiding the real risks

Rules-based transaction monitoring systems are not effectively detecting risk. The result: too many alerts—up to 99% of which are false positives—and mounting costs.

Criminals are becoming more sophisticated

Criminals are hiding their footprints in complex networks of transactions and using electronic trading to take advantage of pitfalls in technology. Without context, money laundering is impossible identify automatically.

AML investigations

Current transaction monitoring investigations use a tick-box approach

Your investigators are dealing with unmanageable amounts of false positives. There’s only so much they can do without the right data.

The cost of compliance is rising

Adding more people to investigation teams will continue to get more expensive. But existing AI models aren’t delivering results or meeting regulatory requirements.

Just some of the benefits

Add Entity Resolution

Add entity resolution to existing capabilities

Remove the need to gather data by automatically joining relevant data records to create a single view of customers and their counterparties.

Understand Networks

Reveal the networks your customers operate in

Uncover connections between transactional, ownership and social relationships to reveal suspicious behaviours and networks, and rapidly identify mitigating factors

Investigate, faster

Conduct more efficient and effective investigations

Create risk scores and mitigating factors to automate the pre-analysis of alerts, prioritize and highlight risks, and empower rapid and accurate decision-making.

Reduce False Positives

Quickly identify false positives and alerts for escalation

Adopt a rapid close process to expedite obvious false positives and escalate clear risk automatically

90

% INCREASE IN FRAUD DETECTION ACCURACY

80

% Faster Investigations

3

% ADDITIVE INCREASE IN MODEL ACCURACY

12

MONTHS BEFORE DEFAULT (CLIENT IDENTIFICATION)

Interested in digital acceleration?

Subscribe to NextWave for occasional email updates on the latest technology, acceleration approaches, news and NextWave events. You can unsubscribe from these communications at any time.